Where a holiday party includes nonemployees such as a business owner s friends customers independent contractors vendors or business associates then employers can deduct 100 percent of the.

Christmas party entertainment deductible.

Entertainment supplied for charity is 100 deductible.

Entertainment enjoyed outside new zealand is 100 deductible.

A party hosted for the sole benefit of employees and their families is 100 tax deductible.

The cost of entertaining your employees as long as it s not incidental to the entertainment of others is deductible for tax purposes.

Tax deductibility of a christmas party.

If both the christmas party and the gift are less than 300 in value and the other conditions of a minor benefit are met they will both be exempt benefits.

Your limited company can claim its festive or annual party as deductible expenses for corporation tax purposes.

If you take the team to the gold coast for christmas lucky them it will be fully.

In such case a deduction is allowed although it is generally limited to 50 of the expense amount.

Annual christmas party as deductible expenses.

But some things haven t changed.

The cost of providing a christmas party is income tax deductible only to the extent that it is subject to fbt.

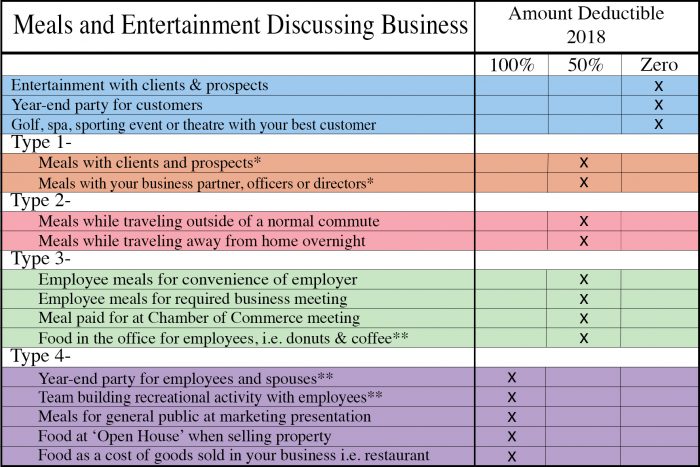

The tcja repeals the deduction for most entertainment expenses effective for amounts incurred after 2017.

Even better the seasonal soirees and small gifts for workers could be tax free.

For your office holiday party to be 100 tax deductible follow these irs guidelines.

Before you begin shopping or sending out invitations though it s a good idea to find out whether the expense is tax deductible and whether it s taxable to the recipient.

Starting with 2018 more stringent rules apply with respect to a deduction for meal and entertainment expenses paid after 2017.

More offices are having holiday parties this year.

For instance if you throw a christmas party for the children s ward at the local hospital this is fully deductible.

The 2018 tax cuts and jobs act brought a few big changes to meals and entertainment deductions.

However if the party also includes the business owner s friends customers independent contractors vendors or any other business related associates it is subject to the meals entertainment limitation of 50.

Here s a brief review of the rules.

The holiday season is a great time for businesses to show their appreciation for employees and customers by giving them gifts or hosting holiday parties.

Invite accordingly according to the irs a standard 50 limit for deducting business related meal and entertainment expenses does not apply to the expenses of providing recreational social or similar activities for your employees.