Chase sapphire foreign transaction fee.

Chase sapphire reserve international transaction fees.

Chase sapphire preferred credit card.

This means you won t have to pay extra when you buy something from a foreign merchant either in person or online.

Both offer bonus points extra points for travel and dining and premium travel benefits.

Using other cards that charge a 1 to 3 fee may not seem like a lot but it can add up.

The chase sapphire reserve foreign transaction fee is 0 as is the case for most travel rewards credit cards.

Chase sapphire cards are popular choices for travelers as both chase sapphire preferred and reserve have 0 foreign transaction fee.

The chase sapphire preferred card which is a top travel rewards card has a 95 annual fee.

The sapphire preferred costs 95 per year while the sapphire reserve is 450 per year with a 75 fee for each authorized user.

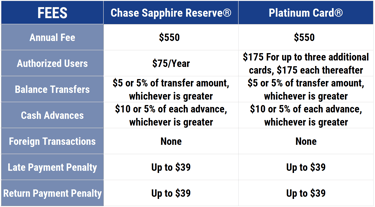

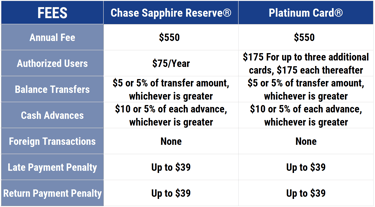

There may not be a foreign transaction fee but whether your card is sapphire preferred or sapphire reserve there are other fees to remember.

Will not be subject to foreign transaction fees.

To offset the annual fee compared to what you would pay if your card had a 3 percent foreign transaction fee.

Because the chase sapphire reserve does not charge international fees it s a great card to use when you re traveling outside of the us.

Sapphire cards with no foreign transaction fee.

But by not paying foreign transaction fees you d only need to spend about 3 200 outside the u s.