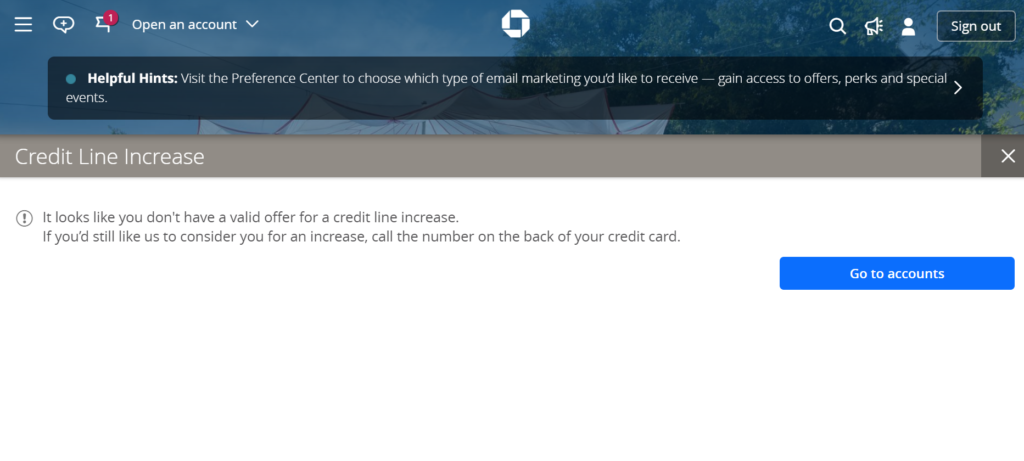

In addition if you are offered more than one pre qualified credit card offer from chase be sure you apply first to the one you want most.

Chase sapphire pulls which credit report.

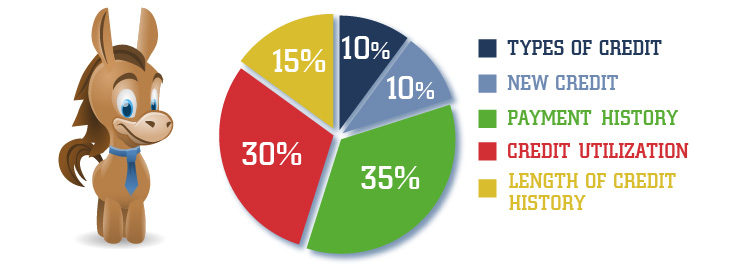

A record of your different credit accounts and how long you ve had them open credit usage.

This application will result in a hard pull on your credit report which can impact your credit score for several months.

A good strategy is to apply for two cards at the same time that way you can combine hard pulls on the same day and minimize the credit inquiries on your credit report if you apply for more than one card on the same day with the same issuer they ll only pull your credit once.

One application will automatically get declined.

A record that shows if you ve paid your bills on time credit history.

Chase sapphire preferred.

Ecs to obtain my credit report and or credit information on a recurring basis to notify me of credit opportunities and other products or services that may be available to me through ecs or unaffiliated third parties and provide me with credit information for my review if such services are made available to.

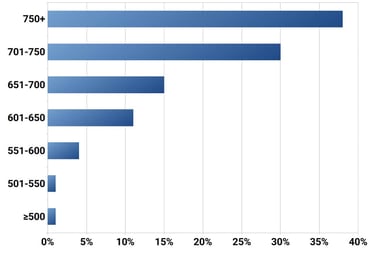

The credit bureau that chase will pull your credit from depends on your location.

It also uses experian as its primary credit bureau and provides bonus points for a set amount of purchases during the first three months.

We reviewed 293 consumer reported credit inquiries from the past 24 months and.

Credit cards mortgages commercial banking auto loans investing retirement planning checking and business banking.

Sapphire is our premier credit card for travel and dining.

The chase sapphire preferred credit card is another of the sapphire credit cards offered by chase.

The card provides 2x points for travel and dining 1x points on all other purchases and 25 more in travel.

The credit report that chase is most likely to pull for your credit card application is your experian credit report.

As of 2018 douple dipping applications no longer work.

3x points with reserve plus a 300 annual travel credit and 2x points with preferred.

Chase will usually pull your credit report from a couple of the three credit bureaus equifax experian and transunion.

The chase sapphire reserve.

Your scores may be different across each bureau.

So banks will usually look at more than one to get a more complete overview.