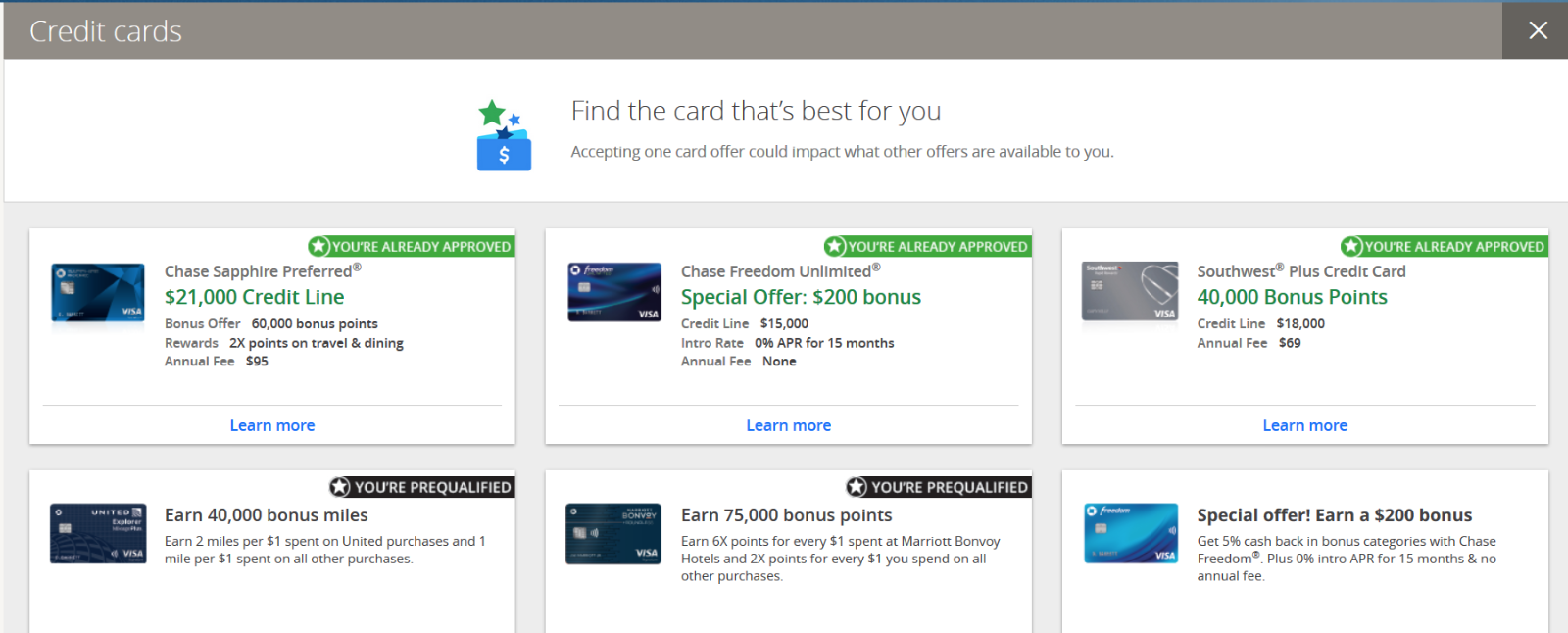

Chase has some of the best points earning cards available so as long as you are under 5 24 5 or fewer cards in the previous 24 months opening a new card is a great way to increase your overall credit limit with chase.

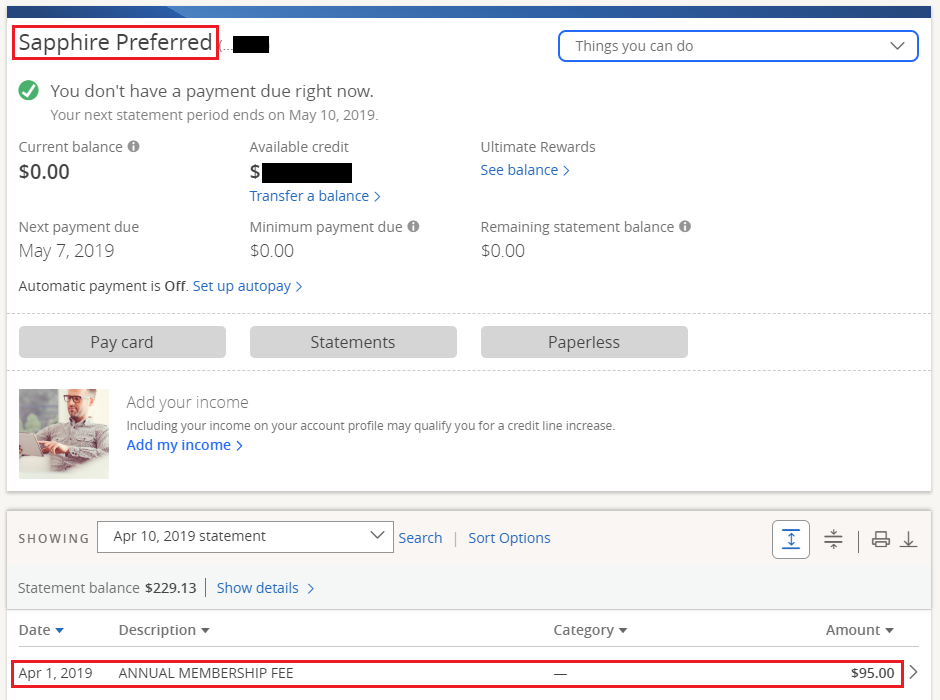

Chase sapphire preferred automatic credit limit increase.

To reach a chase credit analyst over the phone call 888 245 0625.

You can only access the benefits available with your current credit card.

Once you are armed with knowledge of your credit score and payment history you can request a higher credit limit.

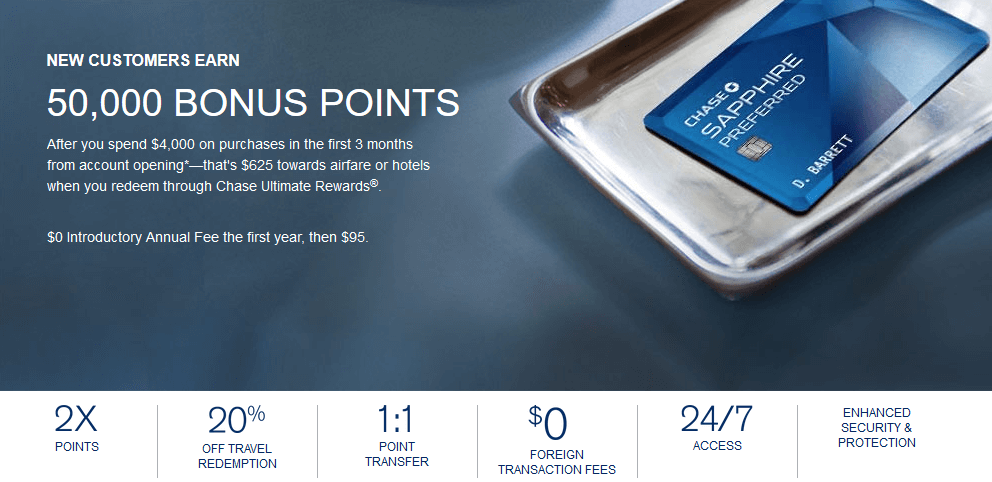

The chase sapphire preferred is a visa signature card for example and the chase.

Occasionally chase might increase your credit limit without you putting in a request.

The chase sapphire reserve is a popular credit card but it comes with a high price tag.

To request and increase via your online chase account click here.

Our in depth analysis explores if the card is worth the cost.

Grocery stores and dining at restaurants including takeout and eligible delivery services home improvement stores such as home depot and lowe s and select.

Luckily there are a few different ways to get a higher credit line from chase.

Unfortunately automatic increases for cards like the sapphire preferred and sapphire reserve are rare but they re not completely unheard of.

The easiest way to increase your chase credit limit is to open a new credit card.

Accounts subject to credit approval.

Restrictions and limitations apply.

Find out how chase determines your credit limit and how to get an increase.

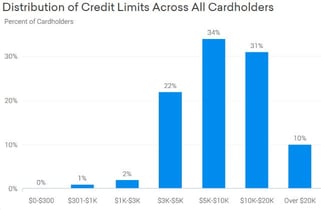

Many chase sapphire preferred users receive a credit limit of 5 000 20 000.

Your chase sapphire preferred account must be open and not in default to maintain subscription benefits.

Sapphire preferred credit cards are issued by jpmorgan chase bank n a.

Requesting an increase by phone if you don t want to wait around for an automatic increase you can call the number on the back of your card and just ask.

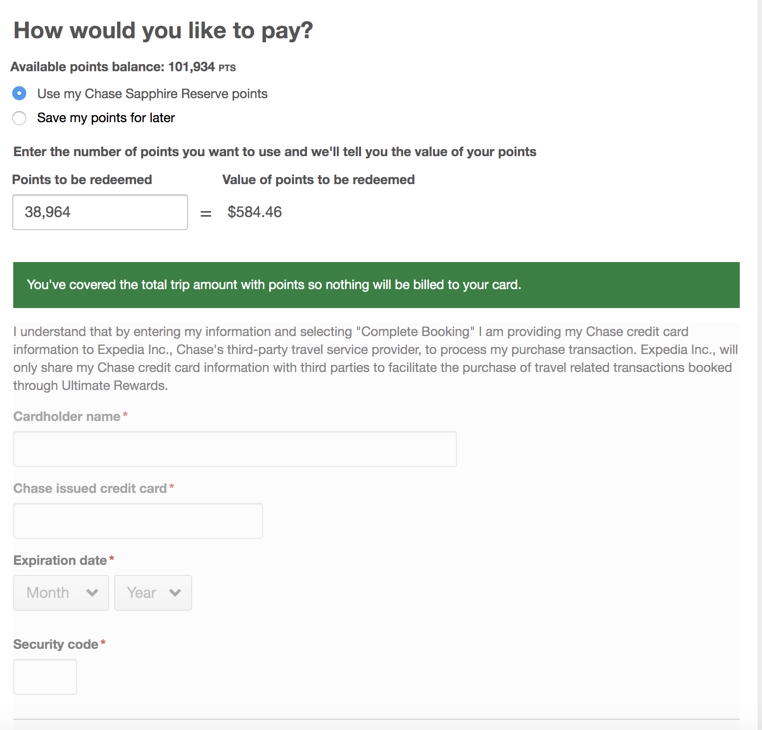

With the pay yourself back tool your ultimate rewards points are worth 25 more when you redeem them for statement credits against purchases in our current categories.